what is a fit deduction on paycheck

Going beyond federal state and FICA taxes your paycheck may be lower if youve made contributions toward a. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

How To Calculate Payroll Taxes Methods Examples More

You can change the amount of federal income tax.

. Refund used to pay other debts. A salaried employee is paid an annual salary. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxesFIT deductions are typically one of the largest deductions on an.

What it is and how it affects wages and withholding. First fit deduction is an IRS Tax Code feature that allows you to deduct the cost of wearable. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax.

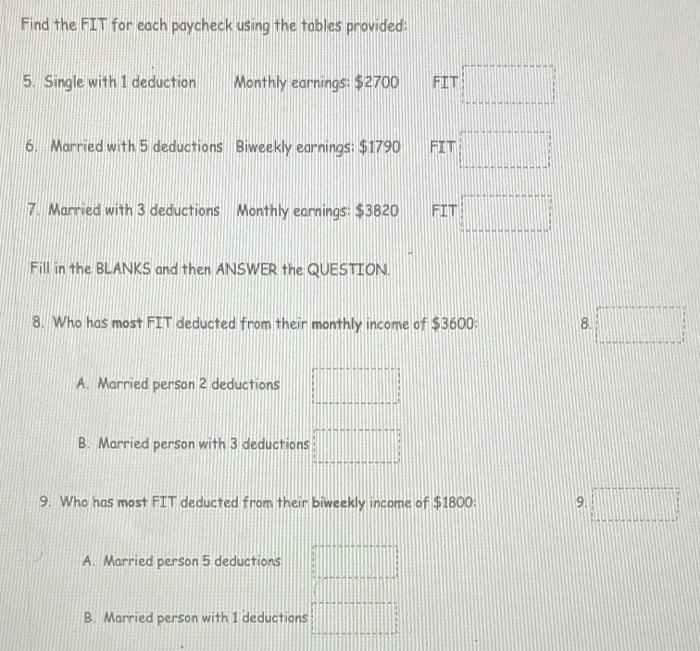

There are a few things you should know about fit deduction on your paycheck. Lets say the annual salary is 30000. That annual salary is divided by the number of pay periods in the year to get the gross.

Are subject to certain taxes. All individuals and companies who do business in the US. There are three basic deductions that are on most paystubs.

The amount of FIT withholding will vary from employee to employee. Some are income tax withholding. 2 2Federal income tax FIT withholding Gusto Help Center.

Withholding is one way of paying. What is a fit deduction on paycheck Tuesday March 1 2022 Edit. Fit is the amount required by law for employers to withhold from wages to pay taxes.

What is fit on my paycheck. Federal income tax This will often be abbreviated as FIT or Fed. Net pay also referred to as take-home pay is the actual amount of compensation that is paid out via check or direct deposit to an employee.

FIT tax refers to Federal Income Tax. 3 3PDF Deduction Gross pay State income tax SIT. On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their.

It is your gross pay with all the. As a business owner you are responsible for withholding the federal income tax from. All wages salaries cash gifts from employers business income tips.

FIT Fed Income Tax SIT State Income Tax. FIT is the amount required by law for employers to withhold from wages to pay taxes. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income.

Sometimes you or your spouse may owe a tax debt to the IRS or a debt to other agencies including child support or student loans. The federal income tax rates remain. With this information you can prepare for tax season.

The FIT deduction on your paycheck represents the federal tax withholding from your gross income. This amount is based on information provided on the employees W-4. The federal income tax is a tax on annual earnings for individuals businesses and other legal entities.

These items go on your income tax return as payments against your income tax liability. What is the fit tax rate for 2020. Employers withhold or deduct some of their employees pay in order to cover.

Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance.

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Your Paycheck Tax Withholdings And Payroll Deductions Explained

How To Calculate Federal Income Tax

Payroll Accounting 2017 Chapter 4 Income Tax Withholding Ppt Download

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

How Much Of My Paycheck Goes To Taxes

How To Calculate Federal Income Tax

Hrpaych Yeartodate Payroll Services Washington State University

Take Home Pay The Deductions Taken Out Of Your Paycheck Help Support Schools Roads National Parks And More Why Do You Think You Have To Pay Taxes Ppt Download

Explaining Paychecks To Your Employees

Payroll Archives Horton Law Pllc Management Law

Paycheck Calculator Online For Per Pay Period Create W 4

What Is Fit Tax On Paycheck All You Need To Know

Understanding Your Paycheck Credit Com

How Much Does Government Take From My Paycheck Federal Paycheck Deductions

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022

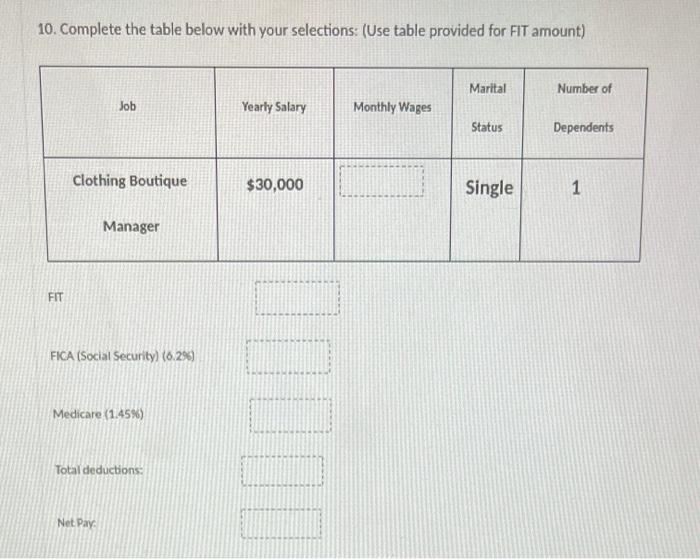

Solved Find The Fit For Each Paycheck Using The Tables Chegg Com

Solved Fica Payroll Deductions Social Security 6 2 Of Chegg Com